CFDI - Comprobante Fiscal Digital por Internet is a digital invoice format used in Mexico and also some other Latin American countries.

CFDI is an electronic XML document issued and registered with Mexico's Tax Authority (SAT) upon sale of goods or services to a customer.

The CFDI includes information about the transaction, such as the type of goods or services sold, the price, and the taxes paid.

As of 2014, all businesses in Mexico are required to issue CFDIs for all taxable transactions.

Customers must use CFDI documents to claim deductions on their tax returns, or verify a transaction.

CFDIs are an important part of the tax system in Mexico and ensures that businesses are complying with their tax obligations.

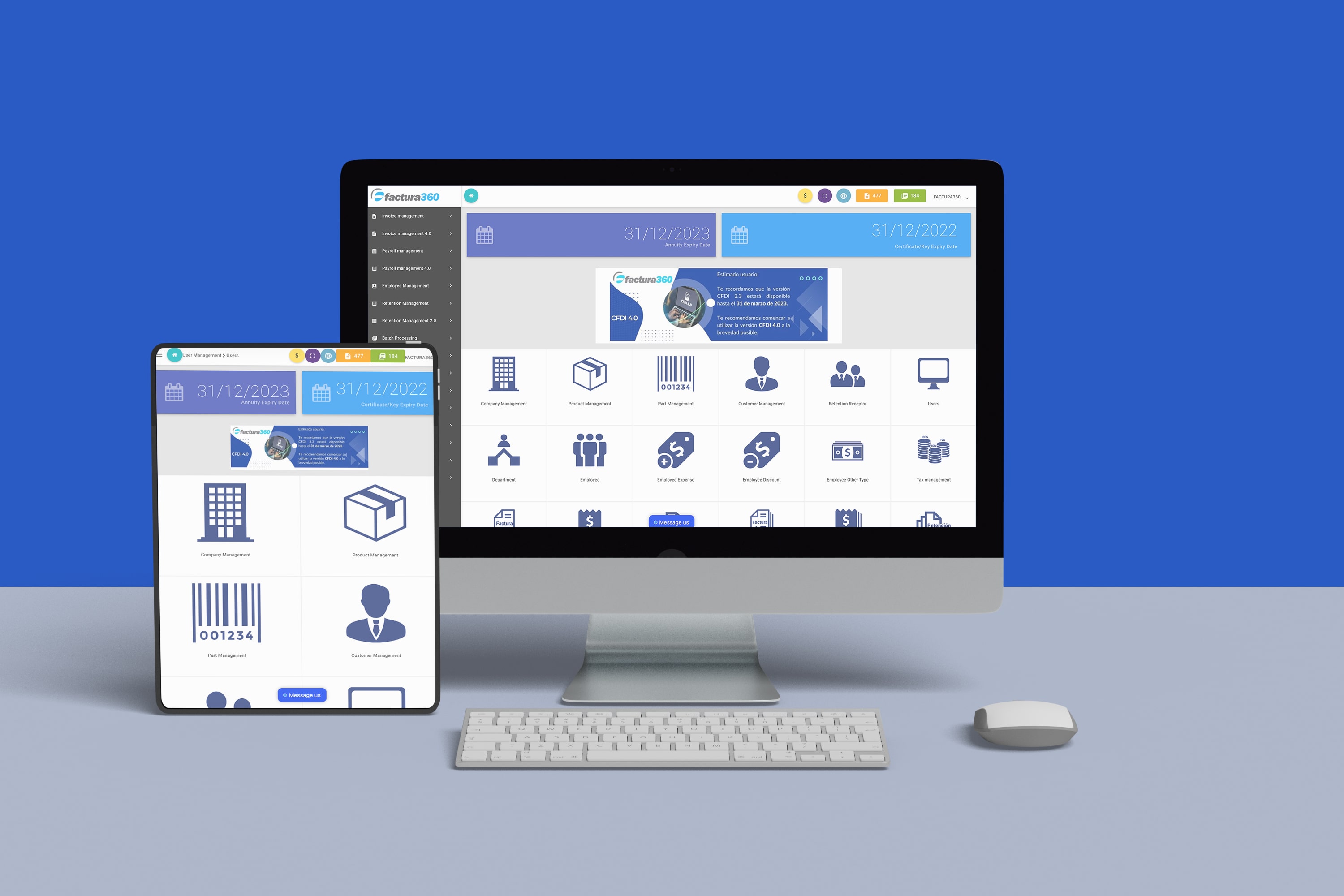

is a SAT Recognized authorized provider with the powers to facilitate generation of CFDI Compliant Invoices in Mexico and has been providing invoicing as a SAAS service since 2015.

Factura360® wanted to provide the following benefits to the customers

Allow both large and small businesses to be easily CFDI compliant

Create sealed CFDI documents fast, at a rate of 5 documents/second.

Allow maximum flexibility in terms of the types of businesses covered, and types of documents supported

Easily integrated with minimal adjustments to the company's existing system, regardless of technology.

Offer the customers flexibility of business specific customizations if required.

Maintain high level of security while storing the customer data and files.

SAAS Solution with SOAP and REST Web Service Interface

Private information encrypted using strong AES Encryption

Multi Tenant White Labeled Solution

Proprietary batch TXT format for fast bulk invoice processing

Proprietary document validation engine for fast document validation

Laravel Framework for PHP

Laravel Framework for PHP

Angular framework for Front End

Angular framework for Front End

REST & SOAP APIs for Webservice

REST & SOAP APIs for Webservice